Hidden Natural Resource Treasures

Episode #5

This video begins in:

Episode #5

This video begins in:

A Global Resource Hunter Special Report ...

|

Why Did I Just Fly into the Wilds of Alaska? For the Chance at a 450% Profit!

The typical Wall Streeter would never dream of hopping on a plane to investigate ANY stock ... let alone fend off grizzly bears to check out a literal gold mine.

But have you ever dreamed of joining the handful of people who DO go to the ends of the earth to uncover the hidden natural resource treasures before they ever hit Wall Street’s radar screen?

If you’re into adventure and travel ... and if you want to be among a small group of people with the chance for gains as high as 450% ... then this is the invitation you’ve been waiting for.

Gold is setting record price after record price! Yet the supply of big new discoveries is critically small. That’s why I just flew into the wilds of Alaska to check out an up-and-coming gold explorer.

Even before I made the journey, I knew ...

But as I’ve learned from many years of doing this, you CAN’T just rely on numbers from the company ... or, worse, from third-party analysis.

Far from it!

If you want the biggest profit potential — the kind of investments that can increase four-fold! — you have to go there in person. You have to shake hands with the management and operators. And you have to independently verify their plans to bring a project from dream to producer.

That’s precisely why I did what most analysts can’t — or won’t — do. I dropped everything and hopped on a plane to Alaska to go see things for myself.

I’ll tell you more on what I found — along with four other investments I recently uncovered — in a minute.

First, let me introduce myself and explain precisely WHY I’m willing and able to go to the ends of the earth to make these discoveries.

|

My name is Sean Brodrick, and I’m Weiss Research’s natural resource analyst.

I’ve traveled from diamond fields north of the Arctic Circle to an ancient city of silver and mummies in Mexico to a gold project so far south in Argentina that penguins waddled up to check out what I was up to. And I’ve been to all sorts of places in-between.

What do I look for? Gold ... silver ... copper ... crude oil ... natural gas. All the riches of the world.

|

And fortunately for me, I have a terrific business partner who shares my passion for these investments.

His name is Kevin Kerr, and he’s not just my personal friend but he’s also very possibly universally recognized as one of the best commodity traders in the business.

Kevin’s record is so good that investors who have followed his recommendations since 2004 could have achieved a total return — including winners and losers — of 1,133%!

Kevin practically grew up in the trading pits of Chicago and New York, though now he makes his home in Estonia, one of the Republics carved out of the former Soviet Union.

We make a great team. Because while I’m off traveling to a remote location where there might not even be running water let alone cell phone reception, I can rest assured that Kevin is back home glued to a screen watching the markets and our other positions.

Of course, I don’t want to give you the impression that Kevin is just some trading geek. He loves going out in the field as much as I do.

Sean's Travel Itinerary

Alaska – August 2011 Vancouver, Canada – May, 2011 Near the Petrified Forest, Arizona – April, 2011 Dominican Republic – February, 2011 Veracruz, Mexico – January, 2011 San Francisco, California – November, 2010 Toronto, Canada – September, 2010 Idaho – July, 2010 |

In fact, Estonia is an excellent jumping off point for exploring the uncharted riches that were long-concealed under the iron curtain.

Kevin is within striking distance of oil fields in Siberia, rare earth element opportunities in Kazakhstan, and rich gold and uranium finds in Finland. And he’s a lot closer than Wall Street to the latest opportunities in China and India as well!

Together, we’ve got the entire globe covered.

And when Kevin is out investigating a new investment, he can also completely concentrate on his task at hand ... because he knows that I’m there holding down the fort whenever HE travels!

We like to think of ourselves as the dynamic duo of global resource hunting because we love the adventure and the number crunching equally!

Okay, But Still, Why Go Through All This Trouble?

Why Not Just Stick to the So-Called “Tried And True” Investments?

Simple: Kevin and I don’t think you can trust the fat-cat predators who are giving Wall Street a bad name.

We want to find investments off the beaten path — projects and opportunities with home run potential that can protect you from inflation and hand you REAL profit potential.

And we want to find them for you BEFORE they become household names.

Like most resource investors, Kevin and I love gold and silver.

But we also recognize that sometimes money is ripening in farm fields, waiting to be harvested by investors with years of experience in the grain markets ...

We know there are enormous profits in “black gold” — that is, crude oil, natural gas and coal discoveries with the potential to reshape the global markets and put America back in charge of her own energy future.

And we’re hot on rare earths, too — the metals of the future that are currently pursued by companies in China, Japan, the U.S. and more.

It doesn’t matter if it’s a brand-new discovery or a new technology that is getting additional resources out of an old mine or oil field. We love them all.

We just insist on a natural resource focus. And here are just three reasons why:

Reason #1: The U.S. Dollar Is Losing Its Safe Haven Status ... Fast!

|

It used to be that when investors worried about stocks, they’d go into cash. While they are still doing that to a certain extent, take a look at a longer-term chart of the U.S. dollar.

As you’ll see, the dollar is being hammered lower by a weakening economy and increasing expectations that the Fed will unleash even more funny money to try and boost the economy.

|

Natural resources — gold, silver, wheat and more — are priced in dollars. So when the dollar goes down, they tend to go up. It’s what I call the “seesaw of pain.” Somebody’s always going to be hurt. And when the pain is handed out, be sure you’re on the right side.

Reason #2: The Rise of China and Other Emerging Markets.

70 million people worldwide are joining the world’s middle class each year, according to Goldman Sachs. In 20 years the middle class will add another 2 billion people, most of them from emerging nations.

These new members of the middle class want everything that you and I have. They want cars, air conditioners, dishwashers and TVs. And all these things take iron, copper, nickel, silver and other metals to produce, and this upshift in lifestyles requires a tremendous increase in energy usage.

So what’s that mean? More and more demand for commodities of all types!

Plus, there’s still ...

Reason #3: We’re Simply Running Out of Cheap Resources!

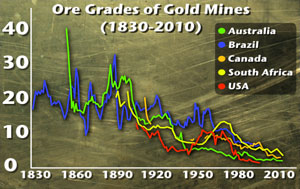

Let me show you one chart on gold that explains the problem in a nutshell ...

|

This chart shows ore grades of gold mines on the major continents of the world over time. As you can see, at the beginning of the 20th century, the AVERAGE ore grade at a gold mine was a little under 20 grams per metric tonne. Now, it’s just a little over 1 gram per tonne.

That means that a little over 100 years ago you could find around 20 grams of gold per metric tonne of ore at mines in Australia, Brazil, Canada and South Africa. Now, there are mines starting with less than a gram per tonne of gold.

It’s not for lack of looking that ore grades are going down. Spending by gold explorers rose by $1.9 billion to $5.4 billion last year.

Instead, it’s basic math: Lower grades and higher mining costs should mean higher gold prices.

And it’s not just gold. This is happening in one commodity after another. Why do you think that oil companies are drilling wells in the ocean that are as deep as Mount Everest is high — inventing new technologies along the way to do it?

These drillers are going literally to the ends of the earth not because it’s fun. It’s because the near-surface, easy-to-pump oil is gone. And as extraction costs go higher, end-prices go higher.

Bottom line: No matter what way we look at it, Kevin and I think natural resources are the very best investments in the world right now. That’s why we’ll stop at nothing to uncover the very best opportunities ... no matter how far we have to fly to find them!

Fortunately, we actually ENJOY doing this hard work. And we’re even happier to share what we find with the folks who can benefit from our research the most — regular investors like you.

So, Without Further Ado, Let Me Introduce You to Four

Resource Investments That Are Currently on

Our Global Resource Hunter “Buy List” ...

Global Resource Hunter Buy #1: A Miner That Could GIVE AWAY Its Silver and Still Make Gobs of Money!

I’ve already given you some of the reasons for buying precious metals right now.

But let me just say that silver is especially attractive because it’s like gold on steroids. Heck, a 5% move in gold can turn into a 10% move in silver!

That’s why Kevin and I are particularly fond of a company that is based in China and produces enough base metals that its cost-per-ounce of silver is negative.

In other words, even if it gave away its silver, it would still make gobs of money!

Better yet, it is expanding its resources and has plenty of cash reserves, and it recently thought its stock was so cheap, it started buying it back!

|

If silver goes to $100 an ounce — which is very possible in the next couple years — this stock could triple!

I’ll tell you all about this company in a free report that I want to send you, along with more information on the irresistible forces that are driving gold and silver higher ... plus the other ways you can play the precious metals market.

But before I tell you how to get that report, let me tell you about ...

Global Resource Hunter Buy #2: An Undervalued European Agribusiness Ready to Reap a Bushel of Gains!

It’s no secret that more and more people need more and more food, with the global population expected to hit 7 billion people this year.

As a result, demand has surged for things like meats, better quality grains, soft commodities including coffee, cocoa, and sugar. This huge increase in demand is rapidly outstripping supplies of many key resources, and putting a strain on an already overloaded agriculture system.

That’s why Kevin and I like a large, European agribusiness company that markets seeds and pesticides around the world.

It’s a leader in crop protection, and ranks third in total sales in the commercial agricultural seeds market. And while it’s a foreign company, you can buy it right here on a U.S. stock exchange.

All our research on this company — including very specific buying instructions — is available in another report that I want to send to you today.

Better yet, that report will also introduce you to other ways to make soaring food costs work for you — everything from fertilizer and seed producers to how to trade the soybeans, wheat, and corn themselves!

Details on how to download your copy in just a minute. First, here’s ...

Global Resource Hunter Buy #3: The Rare Earths Company with a Game-Changing Use for Cerium!

You likely use rare earth metals every day and don’t even realize it. That’s because rare earths are vital components for modern consumer goods — like rechargeable batteries, DVDs and fluorescent lighting — and also in many environmentally friendly technologies. But prior to the digital revolution and the green movement, most investors had never heard of them.

In rare earths, as is often the case in the mining industry, cash is king and so is a unique angle. And one company that Kevin and I favor has both.

It is by far the Western leader in rare earth production, with a mine in California and other properties, including one in Estonia.

Plus, this company has an ace in the hole: They have developed a water purification filter that uses the most abundant rare earth, cerium, which can purify water of virtually any condition.

Here’s the part you have to understand: Many rare earth companies produce a lot of cerium when they produce other rare earths.

So the fact that this company has found a use for all that cerium, is an absolute game changer!

I think this stock will likely double in the next 18 months. That’s why it’s urgent you also get our free report on this stock, along with one last bulletin on ...

Global Resource Hunter Buy #4: A Pipeline Operator with Rock-Solid Financials and a Fat Dividend Yield!

As much as Americans bitch and moan about the pain at the gas pump, we aren’t in the driver’s seat when it comes to fuel demand anymore.

U.S. oil demand is actually expected to go DOWN — but we’ll be paying higher and higher prices due to the soaring demand in the rest of the world.

China should account for 41% of demand growth over the next five years. Emerging markets make up most of the rest.

And perhaps the best way to play this shift in oil consumption is by investing in the one company that pumps more crude oil through its vast network of pipelines than nearly any other U.S. firm.

Heck, it already has more than 5,400 miles of pipe and it’s continually buying up competitors to fuel further growth!

Its financials are rock solid, with sales and earnings both growing. Plus, it pays a fat dividend yield to boot! Over the next 18 months, Kevin and I think your investment in this company could easily double!

In your fourth free report, we’ll give you our big-picture forecast for oil and gas prices ... tell you about funds that should ride that trend higher ... and introduce you to this pipeline operator that should soar with the next surge even as it pays hefty dividends.

Now, here’s how you can download your reports on this potential profit gusher AND the other three red-hot stocks I just told you about ...

The Kevin Kerr Report Card

Compiled and Verified by Weiss Research

Notes: 40 trades were doubles or better. NINE were triples or better. Confirmed by: |

||||||||||||||||||

Kevin and I just got done putting the finishing touches on the series of reports I just described and although we would typically charge $89 for each one, we want to send the entire group of them to you today ... absolutely free of charge.

Of course, the last thing Kevin and I want to do is just introduce you to these four red-hot opportunities and then leave you wondering what to do next.

Instead, we want to make sure that you continue getting our updates ... that you receive all of our dispatches from the distant places we visit ... and that you get the specific trading instructions you need to navigate these volatile markets.

That’s why we’ve decided to package these free reports with a risk-free, trial subscription to our monthly letter, Global Resource Hunter.

The Global Resource Hunter service is designed to help you ride the commodity supercycle — an ongoing surge in the price of food, energy, metals and more — that should continue for years to come.

Global Resource Hunter recognizes that ...

In each monthly issue, you’ll get the latest trends in commodities and other inflation-fighting investments. Plus, you’ll also get:

And by the way, that red-hot Alaskan gold developer that I visited is a company that ...

It’s a stock you’ll want to own ... so you can tell your friends and neighbors you owned it “way back when” as you laugh all the way to the bank.

And You Can Get All of This for

Less Than I Pay in Excess Baggage Fees!

Other analysts charge as much as $1,995 ... $2,995 ... or even as much as $5,000 per year.

And I have to tell you: It isn’t exactly cheap for me and Kevin to travel all over the world, performing our on-the-ground research and maintaining offices on both sides of the world.

But we still believe very strongly in finding a way to getting our discoveries to investors like you ... rather than sharing them with the lazy Wall Street fat cats who should be doing their OWN research.

That’s why we’ve set the regular annual rate of our letter at just $149.

Now, doing that won’t make us rich. But if we get enough like-minded folks to join us, we figure we’ll be able to do what we love — scouring the globe for hot new resource opportunities — while ALL of us can benefit from the fruits of our labor.

Of course, as part of this special Charter offer, we’re offering you the chance to join Global Resource Hunter for just $74 a year!

Heck, I’ve recently paid as much as $50 just to take one extra bag on a regular domestic flight ... so I think you can see why this rock-bottom rate is a tremendous value.

And that’s before you consider that you’ll also be getting all four of those special reports — a total value of $356 — for free, as well!

Just to recap, you’ll get:

|

Add it all up, and the total value of these savings and the urgent reports is a whopping $431!

And while profits are never guaranteed, and losses can and do happen, when you consider all the profit potential in our recommendations, I think it’s fair to say that your $74 investment in our service could pay for itself MANY times over.

Better yet ...

If You Don’t Make Five Times the Cost of

Our On-the-Ground Research Within the First 90 Days,

You Don’t Have to Pay One Red Cent for It!

We are 100% confident that you’ll be thrilled with your membership in Global Resource Hunter ... so much so that we are going to offer you a 100% membership guarantee:

Follow us around the world looking for natural resource opportunities for the next 90 days ...

And if you don’t make at least five times as much money as you spent for our recommendations ...

Heck, if you’re disappointed in any way — in the opportunities we bring you, the editorial content, our customer service ...

Simply let us know and we’ll give you a full refund on the price of your subscription! Plus, everything you’ve been receiving up until that point — including all those reports — are yours to keep just for trying us out.

Of course, I can make this iron-clad promise because I’m confident you’ll want to stick with us. Especially because that undiscovered gold project at the top of the world is just one of many, many great investing ideas we’ll bring you all through the year.

That’s why, when you join us now, you’ll also get complimentary enrollment in our “Low Price Guarantee”:

Here’s how that works ...

Each time your membership comes up for renewal, we’ll notify you first, then automatically bill your credit card at the same deeply discounted rate of $74.

You’ll never pay more than that, no matter how many price increases there are in the future ... you will never miss a single “buy” or “sell” recommendation ... and you will never pay for something you don’t want.

All you have to do to take advantage of this special offer is click below.

There’s just one hitch:

This Special Charter Offer is only good for a limited time!

Look, in our time together today I’ve explained why Kevin and I believe the very best investments in the world revolve around scarce natural resources ...

I’ve told you why we literally go to the ends of the earth to not only find these opportunities but to verify that they are exactly what they should be ...

And I’ve invited you to join us as we continue to travel the globe in search of investments that can rise up as much as 450%. But it’s up to you. If you’re happy with more mainstream investments ... if you trust that companies are generally honest in their reports ... and if you think analysts can do everything from behind their desks, then we’re probably not the right guys for you.

However, if like us, you recognize that the very best opportunities are not always advertised on CNBC, then Kevin and I would really love to welcome you aboard Global Resource Hunter!

And as a member you’ll get ...

Just click below to secure your charter membership right now!

The time for waiting is over: Let other people sit at home and miss out while you join Global Resource Hunter for the ultimate in adventure and profit potential!

Yours for rich resource income and profits,

Sean Brodrick

Co-editor, Global Resource Hunter